Transporting SNF Residents: Choosing the Proper Payer

This week the industry experts at Page, Wolfberg and Wirth (www.pwwemslaw.com) posted an excellent article in the EMS Legal Update on EMS1.com regarding how to choose the proper insurance payer when transporting Skilled Nursing Facility residents by ambulance. The information is so important that we decided to share with you in our blog space this week. We hope you take time to read this important information as prepared by PWW staffer Amanda Stark.

To avoid overpayments or submitting false claims, you must have a process in place for identifying the proper payer for each transport

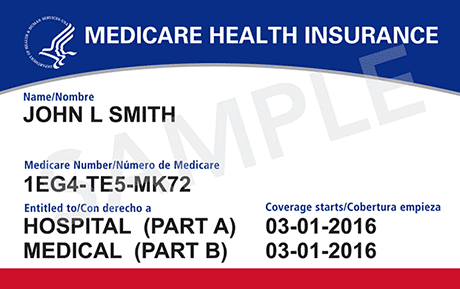

When you transport a Medicare beneficiary, you should always bill Medicare, right? Wrong! There are times when the bill should instead go to the patient, a group health plan, hospice, a hospital or a skilled nursing facility (SNF). The key to compliance and proper billing is evaluating the transport and determining which payer is responsible.

Any time you receive payment from Medicare when you shouldn’t have, such as when another payer should have been billed, it is an overpayment that must be refunded. To avoid overpayments, or worse, accusations of submitting false claims, you must have a process in place for identifying the proper payer for each transport.

Medicare Part A and B

Of particular interest to the Office of Inspector General (OIG) right now is transports that were billed to Medicare Part B, but should have been billed to a skilled nursing facility. The OIG updated its Work Plan in July to add this as an additional ambulance focus area. The OIG will be investigating to determine whether ambulance transports paid for by Medicare Part B were subject to SNF consolidated billing requirements and, therefore, should have been paid for by the SNFs where the transported patients resided.

We are aware of ambulance services and billing companies who have already received requests from the OIG for more information regarding specific transports of SNF residents. In these requests, the OIG is attempting to determine if the EMS agencies and billing companies have a process in place for determining the proper payer for the transport based on whether the patient was in a Part A stay and the reason the patient was transported.

To make sure you are billing the appropriate payer, it is critical to know the rules for billing for transports of SNF residents. Generally speaking, a transport of a SNF resident in a Part A stay, is billable to the SNF, not Medicare Part B [1].

A Part A stay is the first 100 days of a patient’s stay in the SNF, although it may not be 100 consecutive days if the patient was discharged from the SNF or admitted to the hospital. The best way to determine if the patient was in a Part A stay at the time of transport is to ask the SNF during call intake. If the patient was in a Part A stay at the time of transport, then you should send the bill for the transport to the SNF.

SNF Billing Exceptions

Although transports of SNF residents are usually billable to the SNF, there are exceptions. Regardless of if the patient is in a Part A stay at the time of transport, you should always bill Medicare Part B, if coverage criteria is met, when the transport is for:

- Initial admission to the SNF

- Final discharge from the SNF

- Dialysis treatment

- Admission to another SNF when the patient is not in a Part A stay

- Hospital outpatient services listed in the Medicare Claims Processing Manual, Chapter 15, Section 30.2.2

Keep in mind, all transports, whether Medicare Part B or the SNF is responsible to pay, must be medically necessary. However, when it’s the SNF’s responsibility to pay, you are not required to obtain a PCS and you can bill for transports to destinations that Medicare Part B does not cover, such as doctors’ offices.

As with transports billable to Medicare Part B, if the transport is not medically necessary, the patient should get the bill for transport. An Advance Beneficiary Notice (ABN) is not required in order to bill the patient in that situation, although it can be helpful to give patients notice that they will be getting a bill.

Now is the time to take a close look at your procedures for determining the proper payer for each transport. If you have received payments from Medicare Part B when a SNF should have been responsible for payment, you should refund the overpayment within 60 days of identification. Correct and improve your processes going forward to make sure you bill the proper payer every time.

References

1. 42 CFR 410.41(e)